Statewide - Fast 504 Loan

We help speed up the process to help get your 504 Loan FAST!

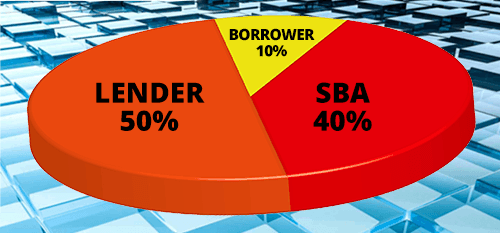

How is an SBA 504 Project Structured?

How do I get Started?

Prequalification is the first step in obtaining SBA 504 financing for your project. To perform a prequalification, we request the following information.

- Three years corporate/company tax returns (Schedule C’s in the case of a sole proprietorship)

- Interim (current year) financial statements (no older than 60 days)

- Personal financial statement(s) (from owners of 20% or greater of the business): Click here to download form

- Three years individual tax returns (from owners of 20% or greater of the business)

- Schedule of business debt: Click here to download form

- Description of property and building improvements (if applicable)

- Contact your SBA loan expert to get started

504 Frequently Asked Questions

An SBA 504 loan is a government-backed loan designed to help small businesses purchase commercial real estate and equipment. It’s structured with 50% bank financing, 40% SBA funding through a Certified Development Company like Statewide CDC, and 10% from the borrower.

- Low Down Payments: Only 10% down payment—free up your cash

- Below-Market, long-term fixed Rates: Fully amortized with no additional collateral required

- Long Repayment Terms: 10 years for equipment and up to 25 years for real estate.

- Ideal for businesses looking to purchase or upgrade real estate, buy heavy machinery, or acquire large equipment.

Must be U.S.-based, occupy at least 51% of the purchased property, and for-profit small businesses with a net worth under $20 million and an average net income under $6.5 million over the last two years may be eligible.

SBA 504 loans typically range up to $5 million for most borrowers, and up to $5.5 million for manufacturers or energy-efficient projects.

504 loans can be used to purchase land, commercial buildings, machinery, or to renovate existing property for business use.

Most SBA 504 loans close within 30–60 days, depending on the complexity of the project and how quickly documentation is submitted.

Yes, the property or equipment you are financing typically serves as the collateral for the loan.

Additional Links

Rates

504 Debenture Rates

Sample Project

Typical 504 project